The state of Oregon is seeking input as it nominates areas for federal Opportunity Zone designation

The Tax Cuts and Jobs Act of 2017 established a new federal tax incentive to encourage long-term investments in certain low-income communities. The “Opportunity Zone” designation allows private investment in these communities from new “Opportunity Funds.”

Private investment from an Opportunity Fund within an Opportunity Zone may earn tax relief on both the capital gains invested in the fund, and gains generated through the investment by the fund. An Opportunity Zone is a low-income community census tract designation to be made by the U.S. Department of Treasury.

Each state’s governor may nominate eligible census tracts already designated as a “Low Income Community” (LIC) by the federal New Market Tax Credit program. Low Income Communities are tracts with a poverty rate of at least 20% or with median family incomes that do not exceed 80% of area median income. Of Oregon’s 366 eligible LICs, the state may nominate no more than 86 to be designated as Opportunity Zones.

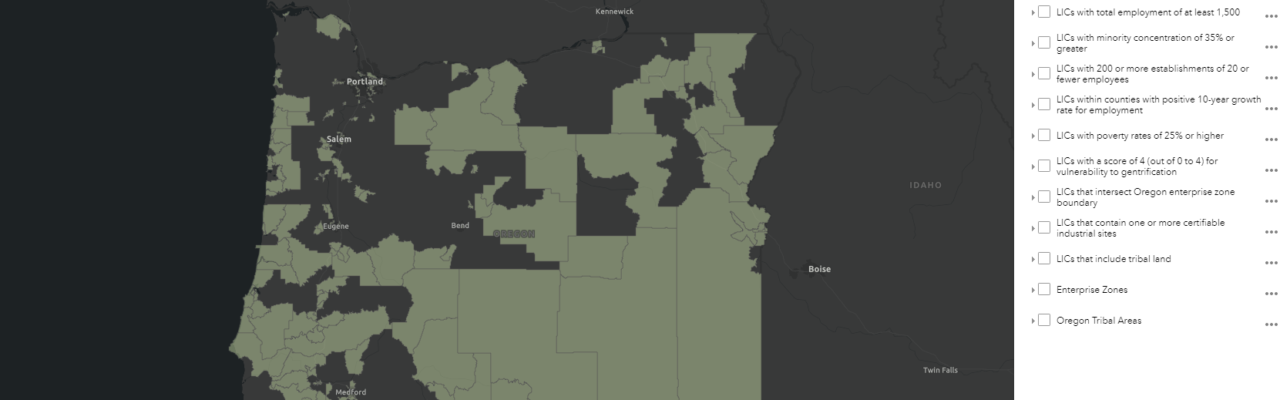

Business Oregon created a web page with currently available information on the process, and a form to solicit input from the general public. Linked from that page is a map to help communities locate eligible LIC census tracts. The map includes economic data that may be useful in identifying areas that could benefit from zone status as well as attract investment. The state of Oregon is also partnering with the Association of Oregon Counties, League of Oregon Cities, and each of Oregon’s nine federally-recognized Tribal Governments to solicit local and tribal government feedback

The web page will be updated as Business Oregon gets more information on the program from the U.S. Department of Treasury. To ensure Oregon meets nomination deadlines, all input is due by 5:00 pm on March 14, 2018.

More information at: